-

Taxes

TaxesS Corporation Election Demystified: A Successful Guide to Financial Plan for Small Business Owner

Financial edge for small businesses: Find out the strength of S Corp Election. Optimize tax benefits with confidence.

Jan 16, 20248113 -

Mortgages

MortgagesRefinance a Car Loan

You can refinance a car loan anytime, but doing so requires several important considerations beforehand. So, when can you refinance a car loan?

Jan 15, 20246514 -

Know-how

Know-howReview Of Hippo Homeowners Insurance

Hippo Homeowners Insurance is an online provider of many types of protection, such as homeowners, flood, and liability policies. Customers may manage their policies, submit claims, and access a network of reputable service providers using the company's user-friendly digital platform, which leverages intelligent algorithms to deliver customized coverage options at competitive pricing. Most of Hippo's reviews are excellent, with users complimenting the service's intuitive interface, low prices, and wide range of available protection plans.

Jan 13, 20247663 -

Know-how

Know-howProfit From Solar Energy

Solar energy has become increasingly well-known over the last decade since the prices for solar panels have dropped dramatically. Solar power is predicted to be equally cost-effective as fossil fuels in the next few years.

Jan 13, 2024556 -

Banking

BankingAlly Bank Ratings and Customer Reviews

Because of its low costs and high APYs, Ally Bank is one of the most popular solutions for people who want to avoid traditional banking. We've seen better savings accounts, but this bank only has two checking accounts. Furthermore, there is no necessity for a specific level of balance. See our complete Ally Bank review below to discover more about these accounts and everything else Ally Bank has to offer.

Jan 02, 20249821 -

Investment

InvestmentTD Ameritrade Essential Portfolios Review 2022 in Detail

TD Ameritrade Essential Portfolios offer a comprehensive solution for investors looking to build and manage a diversified portfolio with minimal effort. Whether you’re just starting out or already have some experience in the markets, these portfolios can help you reach your financial goals. With its automated process, intuitive tools, and variety of resources, TDAEP makes it easy to build a well-rounded portfolio that fits your individual needs.

Dec 31, 20238149 -

Investment

InvestmentUnderstanding Market Makers

Market maker often called a designated broker, is an investment firm or broker/dealer that plays a crucial part in how the ETF trades also makes sure the constant and effective trading of securities between sellers and buyers.

Dec 24, 20236330 -

Know-how

Know-howCost of Living in Alaska

Get a handle on what life looks like financially in Alaska. Learn about shipping costs, access to resources, and more so you can make an informed decision about your move.

Dec 21, 20232726 -

Mortgages

MortgagesQualified Higher Education

The money that a person spends on tuition, books, fees, and supplies to attend a college, university, or any other kind of postsecondary school is referred to as qualified higher education expenditures, or QHEE for short

Dec 17, 20239579 -

Know-how

Know-howExplain in Detail: How a DUI Affects Your Car Insurance

Auto insurance is not only required in practically every state but also serves as a financial safety net if something goes wrong while you are behind the wheel. You should expect to pay a certain percentage of your annual income for insurance, but the exact amount will be based on several criteria, including your driving record. For example, if you have a clean driving record, your premiums will be lower than if you have a driving record with moving violations. If you are convicted of driving under the influence of alcohol or drugs (DUI or DWI), your insurance premiums may go up.

Dec 16, 20239380 -

Mortgages

MortgagesHow Does a Mortgage Work?

Thinking about taking out a home loan? In this blog post, we'll explain what to expect from mortgages and the basics of obtaining and maintaining one. Read on to learn more!

Dec 13, 20239398 -

Know-how

Know-howDifferent ways to Calculate Return on Assets (ROA)

Return on assets is one of the metrics companies, and investors use to judge how well a firm is operating. It is one of the measurements considered one of the strictest measurements

Dec 12, 20237266 -

Know-how

Know-howUnderstanding the Benefits of Long-Term Care Insurance for Your Parents

Explore why long-term care insurance is a must for your parents. Secure their future, avoid financial stress, and ensure quality care. Read more for a better understanding!

Dec 12, 20239265 -

Know-how

Know-howAll You Need to Know About the Traditional Economy

Are you curious about how societies functioned before industrialization? Discover all you need to know about the traditional economy in this article.

Dec 05, 20231392 -

Know-how

Know-howDifference Between the Prime Rate and the Repo Rate

The prime rate is utilized as an index for rates provided in consumer loans and loans. The repo rate is utilized when central government banks buy securities from private institutions in exchange for money. The repo rate system enables governments to manage the money supply in their economies to increase or decrease the number of funds. Primary rates, as well as repo rates, are both established by central banks.

Dec 04, 20238901 -

Know-how

Know-howPawn Shops for Buying and Selling: Is It Worth It?

Discover the value of pawn shops when buying and selling. Benefit from quick cash and no credit checks, but consider potential risks wisely.

Dec 04, 20233647 -

Know-how

Know-howUnderstand: What to Know About Inheriting a Home

ore than just money or property is at stake when you inherit a home. As a homeowner, you'll have more financial and legal obligations after receiving an inheritance. This could lead to a problematic emotional reckoning and negotiations with siblings and other heirs.

Dec 01, 20239089 -

Know-how

Know-howExplaining How Do Savings Bonds Work

Let’s unlock the secrets of savings bonds with our simple guide! Explore the world of Series EE and Series I bonds and understand how they work.

Dec 01, 20237673 -

Mortgages

MortgagesWhat is the Maximum Amount That May Be Borrowed?

Lenders typically have a limited loan amount they will provide to borrowers. Mortgages, unsecured loans, credit lines, and credit cards can all have upper restrictions set on the amount you can borrow. The maximum loan amount is based on several criteria, including the loan's kind, length, and purpose, the lender's requirements, your past financial history, and whether or not the loan is secured by collateral.

Nov 27, 20236192 -

Know-how

Know-howUnveiling 7 Hidden Auto Insurance Discounts You Could Be Benefiting From

Explore seven less-known auto insurance discounts that you could be eligible for. Uncovering these can lead to significant savings on your policy

Nov 23, 20235428 -

Know-how

Know-howEarly Mortgage Repayment for Rental Properties

Unlock financial freedom by exploring the pros and cons of paying off your rental properties mortgage early. Evaluate tax strategies and repayment options.

Nov 22, 20233886 -

Know-how

Know-howNon-Cash Charges: What is it?

Non-cash charges are those in the books that don't take any money from the company. Learn more about Non-Cash charges!

Nov 11, 20232285 -

Banking

BankingWhat Is A Merchant Category Code?

Purchases made with credit cards are given merchant category codes, sometimes called MCCs. These codes may impact how you accumulate incentives, such as points or cash back.

Nov 02, 20232141 -

Banking

BankingWhat Differs Commercial Banking From Business Banking?

In contrast to business banking, which focuses solely on corporations of all sorts, commercial banking typically services individual clients and smaller enterprises. Business banks provide specialized financial services and products designed specifically for enterprises, whereas commercial banks provide a broad range of services

Oct 23, 2023933 -

Banking

BankingReduce Credit Card Interest

This year, the annual interest fees assessed to a family carrying revolving credit card debt will total $1,155 on average.

Oct 18, 20232227 -

Mortgages

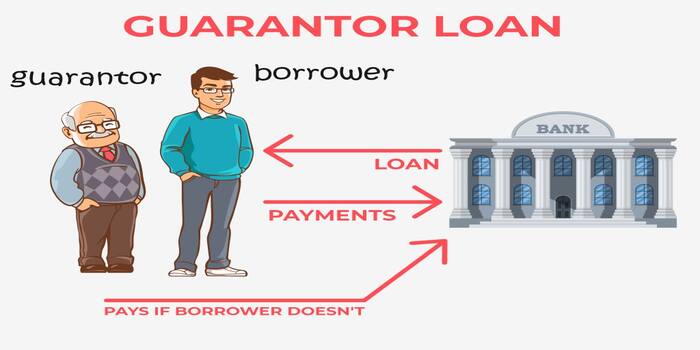

MortgagesA Quick Guide: What Are Guarantor Loans?

The financial phrase "guarantor" refers to an individual who, in the case of a borrower default, will step in to cover the debt. The guarantors' assets secure loans. Sometimes, borrowers would act as their guarantors by putting up collateral against a loan. It's common to practice using the words "guarantor" and "surety" interchangeably.

Oct 14, 20231329 -

Mortgages

MortgagesDoes Inflation Cause a Recession

Are you curious about the relationship between inflation and recession? Dive into this article to understand how they work together and get insights from professional economists.

Oct 14, 20234222 -

Banking

BankingHow Much of Your Credit Limit Should You Use? A Comprehensive Guide

Learn the secrets of effective credit management and discover how to use your credit limit wisely for financial success.

Oct 10, 2023674 -

Mortgages

MortgagesWhat is a No-Closing-Cost Mortgage

Get in-depth information on one of the best financing strategies available for homeowners - the no-closing-cost mortgage. Learn about its advantages, disadvantages, qualifications, and more.

Oct 09, 20236961

-

Banking

Banking5 Best Credit Cards That Offer Free Checked Bags

Jan 16, 2024 -

Banking

BankingCredit Card Tips For Beginners

Jan 16, 2024 -

Taxes

TaxesWhat is Self-Employment Tax?

Jan 16, 2024 -

Mortgages

Mortgages5 Trustworthy Best Business Loan in India

Jan 16, 2024 -

Know-how

Know-howTop 10 Most Successful Businesses to Start: A Comprehensive Guide

Jan 16, 2024