Mutual Funds With the Most Conservative Allocations

Feb 04, 2024 By Triston Martin

Investing in numerous asset classes inside a single, professionally managed fund has never been easier than with asset allocation mutual funds. From ultra-conservative to very aggressive, individual investors may employ a wide variety of asset allocation funds. There are conservative allocation funds that invest in equities and debt securities, as well as cash and cash equivalents, with a primary focus on preserving the value of the principle. Investors concerned about market volatility or wanting to earn income from all or part of their portfolios can easily accomplish their investing objectives by using conservative allocation funds.

Definition Of Conservative Mutual Funds

It is usual to refer to "conservative-allocation funds" as mutual funds with a relatively low-risk allocation. The goal of a conservative portfolio is to offer the investor with both capital growth and income. Stock holdings in traditional allocation funds are lower than in moderate allocation funds, and the level of risk is lower yet than in aggressive allocation funds. To be considered conservative, a portfolio's stock allocation should be between 20 and 50 percent, with the remaining 50 to 80 percent in a mix of bonds and cash.

Who Should Buy Conservative Funds?

An investor with a short- to medium-term time horizon (up to three years) and a limited tolerance for risk could choose a cautious portfolio. Conservative investors are not ready to endure periods of excessive market volatility and are looking for returns aligned with or slightly ahead of the inflation rate.

Top Conservative Investment Funds

Vanguard Wellesley Income is one of the top conservative allocation funds with a history of stable returns that have consistently outperformed inflation (VWINX). For example, in 2008, the S&P 500 Index lost 38.49 percent, whereas VWINX lost only 9.8 percent, beating most conservative allocation mutual funds. A patient investor willing to accept a loss of roughly 10% in one year out of around ten years but still receives average annualized returns well above the inflation rate should choose VWINX.4

Tax-Managed Balanced Fund of Vanguard

One of the most conservative mutual funds offered by Vanguard, the Vanguard Tax-Managed Balanced Fund has a low expense ratio. Investment returns created by federally tax-exempt income, long-term capital appreciation, and current taxable income in a moderate amount are the goals of this mutual fund, established in 1994.

Investments in mid- and large-capitalization stocks and tax-exempt municipal bonds make up the majority of the $4.50 billion in assets held by the fund. All municipal purchases are at least 75% in one of the top three credit rating categories, and the balance is in common stocks.

The American Funds Tax-Advantaged Income Fund

Since its inception in 2012, the American Funds has been available to investors through the American Funds mutual fund family. Conscientious investors may benefit from asset growth and tax-free income with this cautious allocation fund. Most of the assets in the mutual fund are designed to generate revenue from their underlying investments. Hence the fund's investment mix includes many American Funds products in various combinations and weightings. American Funds Income Fund managers concentrate on dividend-paying companies by incorporating growth and income funds and equity income funds, balanced funds, and bond funds into their investing strategies.

T. The Rowe Price Personal Strategy Income Fund.

In 1994, the T. Rowe Price Personal Strategies Income Fund was launched. To offer investors the best long-term total return, the fund management team prioritizes investments that provide income first and capital growth second. 40% of the fund's $2.27 billion resources are invested in equities, with the rest spread across bonds, money market securities, and cash. Depending on the present market state and prospects, the fund may decide to alter the weighting of a particular asset class. The T. Rowe Price Personal Strategic Income Fund has returned an annualized 7.50 percent with a cost-to-return ratio of under 0.60 percent since inception.

The Thrivent Diversified Income Plus Fund

The Thrivent Diversified Income Plus Fund was created in 1997. The mutual fund aims to provide investors with a steady income stream while ensuring long-term financial gains. Common stock, preferred, and convertible stock makes up most of the fund's $901.10 million in assets; the remaining assets are held in bonds. Bonds, notes, debentures, or other debt obligations may be held in the fund of any credit rating and length of the term.

Summary of Conservative Investing

Make a list of your top goals before considering a cautious investing plan. Investments in a moderate allocation fund or a moderate mix of mutual funds may be necessary if your goal is to grow your money over time. Mutual funds aren't ideal if you want a safe investment with no market risk and don't mind receiving near-zero interest.

-

Know-how Dec 12, 2023

Know-how Dec 12, 2023Understanding the Benefits of Long-Term Care Insurance for Your Parents

Explore why long-term care insurance is a must for your parents. Secure their future, avoid financial stress, and ensure quality care. Read more for a better understanding!

-

Banking Jan 16, 2024

Banking Jan 16, 2024Credit Card Tips For Beginners

This article will give an expert view of the best tips to help you use your credit card correctly.

-

Mortgages Oct 14, 2023

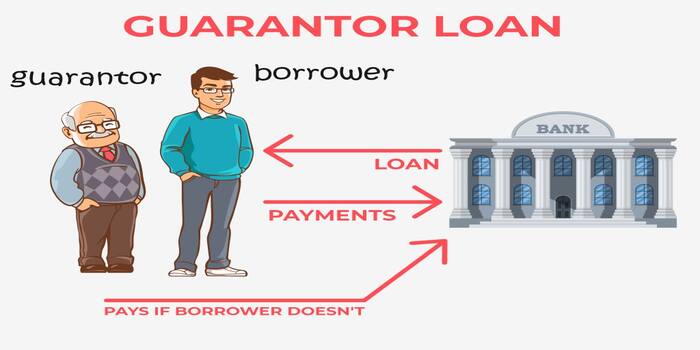

Mortgages Oct 14, 2023A Quick Guide: What Are Guarantor Loans?

The financial phrase "guarantor" refers to an individual who, in the case of a borrower default, will step in to cover the debt. The guarantors' assets secure loans. Sometimes, borrowers would act as their guarantors by putting up collateral against a loan. It's common to practice using the words "guarantor" and "surety" interchangeably.

-

Know-how Nov 11, 2023

Know-how Nov 11, 2023Non-Cash Charges: What is it?

Non-cash charges are those in the books that don't take any money from the company. Learn more about Non-Cash charges!