Different ways to Calculate Return on Assets (ROA)

Dec 12, 2023 By Susan Kelly

Knowing how to calculate the return on assets of a company can help potential investors decide whether or not to invest in that company. It can also help business owners measure how well their company performs from one year to the next compared to other companies operating in the same industry.

What Is a Return On Assets?

Return on assets, often known as ROA, is a ratio that indicates how much of a profit a firm generates due to the resources and assets it has. Because it provides an indicator of how effectively a firm utilizes its resources and assets to make a profit, this information is useful to the owners and management team of a company as well as investors. A percentage is often used to express the return on assets. For instance, if a corporation has a return on assets (ROA) of 7.5 percent, the company makes seven and a half cents for every dollar it has in assets.

Importance of Return On Assets

Return on assets is a valuable measurement that investors and business owners can use to determine how effectively a company uses its assets to generate a profit. You may get started by searching for patterns or shifts in a company's return on assets % from one year to the next and comparing it to the percentage from the previous year. When this is done, investors will have a better chance of determining whether or not a firm is likely to have problems in the future.

Various Ways for Calculating Return On Assets

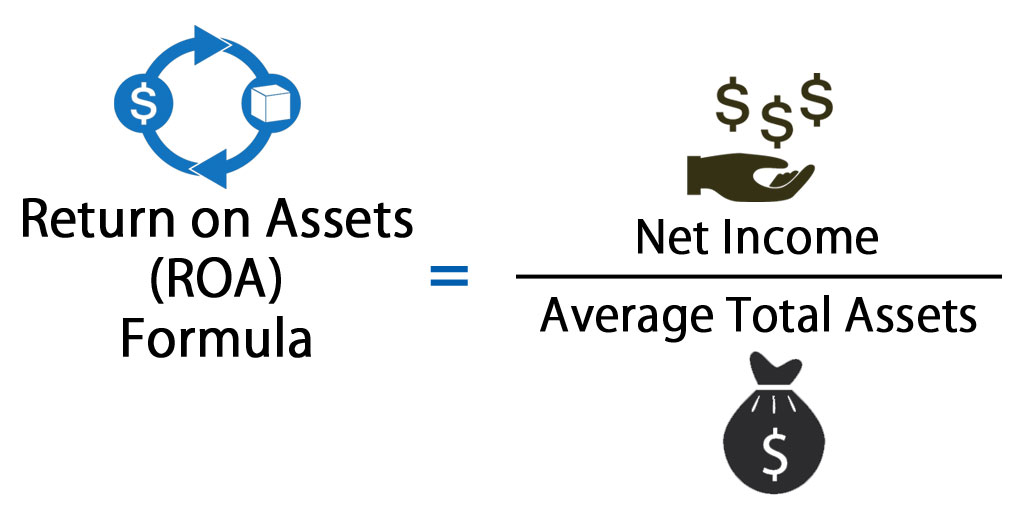

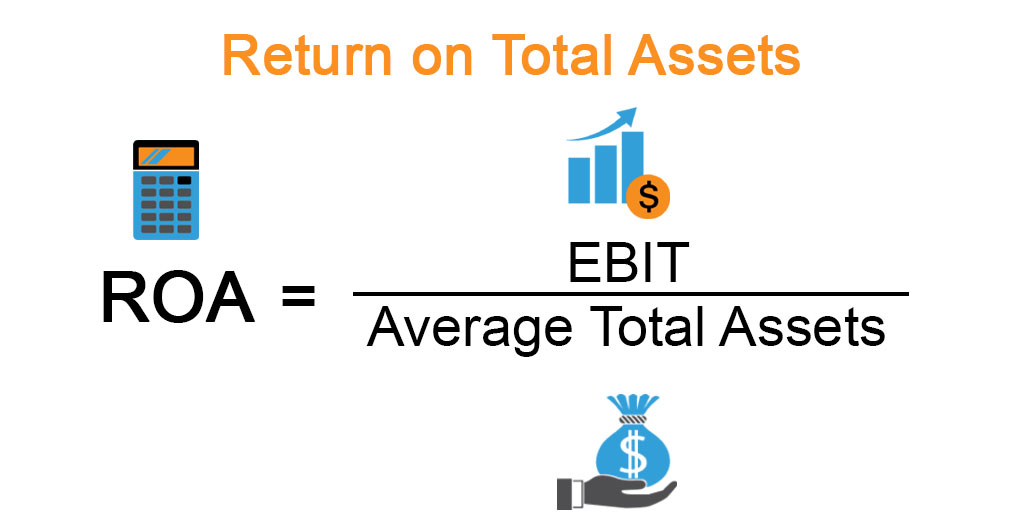

When calculating asset return, you may choose between two distinct calculation approaches. The first approach involves dividing the company's net income by its total average assets. This gives a rough estimate of the company's value. The second technique involves calculating the product of the company's asset turnover rate and its net profit margin.

The Formula For Calculating ROA

When calculating asset return, you may choose between two distinct calculation approaches. The first approach involves dividing the company's net income by its total average assets. This gives a rough estimate of the company's value. The second technique involves calculating the product of the company's asset turnover rate and its net profit margin. To determine a company's return on assets based on the company's net income and total assets, calculate the return on assets according to the following steps:

- Determine the company's income after taxes.

- Determine the sum of all the company's assets.

- Take the ratio of the net income to the total assets.

1. Determine The Company's Income After Taxes

Finding a company's net income is the first thing that has to be done to use this approach to calculate a company's return on its assets. The total revenue amount still available after deducting all of the costs is referred to as the net income. You'll find this particular piece of information at the very bottom of a company's income statement.

2. Determine The Sum of the Company's Assets

The next step is to determine the total amount of assets owned by the firm or the average total assets. Because the total assets of a corporation might change over time, it is possible that using the average total assets will result in a more accurate computation than using any other total asset figure. The balance sheet of the firm contains this particular piece of information.

3. Calculate The Ratio of the Net Income To The Total Assets

If it makes the computation simpler, you may round the amounts for the net income and total assets to the nearest whole number. To illustrate the company's return on assets, the answer should be expressed as a percentage once it has been converted.

Example Of Return On Assets

The following examples illustrate how to compute return on assets with the strategies above and approaches. The computation in the first example is based on the company's annual net income, the computation uses the company's asset turnover rate in addition to the net profit margin. The following information is applied to each illustration:

- Profit after tax: $150 000.00

- The average amount of total assets: $800,000.00

- Total revenue: $1,500,000.00

Exemplification of Method

To calculate the return on assets of the firm based on its net profit margin and asset turnover, first determine the company's net profit margin by dividing its total revenue by its net income. The company's total revenue is $1,500,000, and its net income is $150,000. $150,000 / $1,500,000 = 0.1 (10 percent).

-

Know-how Nov 22, 2023

Know-how Nov 22, 2023Early Mortgage Repayment for Rental Properties

Unlock financial freedom by exploring the pros and cons of paying off your rental properties mortgage early. Evaluate tax strategies and repayment options.

-

Mortgages Dec 13, 2023

Mortgages Dec 13, 2023How Does a Mortgage Work?

Thinking about taking out a home loan? In this blog post, we'll explain what to expect from mortgages and the basics of obtaining and maintaining one. Read on to learn more!

-

Know-how Jan 16, 2024

Know-how Jan 16, 2024Top 10 Most Successful Businesses to Start: A Comprehensive Guide

Top 10 most successful businesses to start in the world, small business with highest profit margin, most profitable business in future

-

Mortgages Jan 15, 2024

Mortgages Jan 15, 2024Refinance a Car Loan

You can refinance a car loan anytime, but doing so requires several important considerations beforehand. So, when can you refinance a car loan?