OTC Pink market Explained: Risks, Rewards, and Company Types

Nov 24, 2024 By Sid Leonard

The OTC Pink market, colloquially known as Pink Sheets, represents one of the riskiest sectors of over-the-counter (OTC) trading. It is a decentralized marketplace where companies that dont meet the requirements of major stock exchanges operate. Although it offers opportunities to invest in early-stage companies or foreign firms, OTC Pink is notorious for its speculative nature and lack of transparency. In this article, we explore the structure and purpose of the OTC Pink market, identify the types of companies that trade there, and analyze the key risks investors must consider.

What is OTC Pink?

The OTC Pink market is the most unregulated tier under the OTC Markets Group, which also manages two other tiers: OTCQX and OTCQB. OTC Pink is the default platform for companies that do not meet the listing criteria of these more regulated tiers. The name "pink sheets" originates from the pink-colored paper that was once used to publish stock prices. Today, all trading is electronic, though the name persists.

This market is appealing to companies that seek to avoid the financial disclosures required by major exchanges. While some firms use OTC Pink as a temporary platform before achieving stronger financial standing, others remain in this space due to ongoing financial distress or a lack of interest in regulation.

Types of Companies in OTC Pink

A broad spectrum of companies utilizes the OTC Pink platform. These firms are often classified into three information tiers:

Foreign Companies: Many non-U.S. companies list on OTC Pink to access U.S. investors without the complexities of meeting SEC regulatory requirements. This provides investors with exposure to international businesses in their formative stages, potentially offering high-growth opportunities if these companies expand successfully.

Start-ups and Micro-cap Firms: Start-ups and small businesses, often with minimal capital or financial history, use the OTC Pink platform to raise funds and establish a market presence. These firms typically lack the resources needed to meet the higher listing standards of major exchanges but seek investment to fuel early growth phases.

Delisted or Distressed Companies: Companies that fail to meet the compliance standards of primary exchanges like the NYSE or NASDAQ may continue trading on OTC Pink. These businesses are often in financial distress or facing challenges such as bankruptcy, making them highly speculative investments with potential turnaround scenarios.

Shell Companies: These firms are primarily established to facilitate financial maneuvers such as mergers and acquisitions. Though they may not engage in regular operations, their strategic existence on the OTC Pink platform plays a crucial role in larger financial transactions, offering unique, albeit risky, investment avenues.

Each company is further classified based on how much information it provides to investors. The categories include "Current Information" for companies that meet OTC reporting guidelines, "Limited Information" for firms with incomplete financial disclosures, and "No Information" for the riskiest entities that provide minimal or no updates to the public.

Key Investment Risks in OTC Pink

Investing in the OTC Pink market carries significant risks, making it a high-stakes endeavor:

Lack of Transparency: Unlike companies on major exchanges, most firms in the OTC Pink market are not required to submit regular financial reports or audited statements. This makes it difficult for investors to assess the companys true financial standing, making due diligence essential.

Liquidity Issues: OTC Pink stocks often experience thin trading volumes, meaning shares can be challenging to buy or sell at a desired price. Investors may find it difficult to exit positions during market downturns, increasing the risk of losses.

High Volatility: The prices of OTC Pink stocks can fluctuate wildly. With limited market oversight and unpredictable investor sentiment, these shares can soar or plummet without warning. While this volatility offers the potential for high returns, it also carries significant downside risk.

Fraud and Manipulation Risks: The OTC Pink market is vulnerable to fraudulent schemes, like "pump-and-dump" strategies, because of its limited regulatory oversight. In such schemes, the price of a stock is artificially inflated, attracting unwary investors, only to be sold off by insiders at a profit, leaving late investors with losses.

Unstable Business Models: Many companies in the OTC Pink market operate without clear or profitable business models. Some firms may be on the verge of collapse or exist only to facilitate dubious financial activities. Without detailed financial disclosures, it is difficult for investors to gauge the legitimacy or sustainability of these companies.

Should You Invest in OTC Pink?

Investing in OTC Pink stocks is not for the faint-hearted. Given the lack of transparency, limited oversight, and unpredictable volatility, only experienced investors with a high tolerance for risk should explore this market. Companies trading in the OTC Pink market often operate with minimal financial disclosure, making it essential for investors to conduct thorough research and maintain constant vigilance when holding these securities.

Professional investors, including hedge funds and venture capitalists, may find unique opportunities in OTC Pink through early-stage companies or distressed firms on the verge of recovery. However, individual investors need to proceed with caution. The speculative nature of these stocks requires careful portfolio allocation, as they carry a higher risk of loss. Experts recommend allocating only a small fraction of one's portfolio to OTC Pink securities, considering the challenges in liquidity and the potential for market manipulation. This high-risk, high-reward environment demands not only patience but also a strategic exit plan to minimize potential losses.

Conclusion

The OTC Pink market is a unique segment of the financial world, offering access to companies that are not available on traditional exchanges. While the potential for high returns is real, so too are the risks. Lack of regulation, transparency issues, and frequent market manipulation make it a challenging environment, even for seasoned investors.

Anyone considering investing in OTC Pink stocks should conduct thorough research, employ sound risk management strategies, and consider consulting with a financial professional. For those willing to take the plunge, the OTC Pink market offers a wealth of possibilitiesbut only for those prepared to weather the storm.

-

Know-how Nov 23, 2023

Know-how Nov 23, 2023Unveiling 7 Hidden Auto Insurance Discounts You Could Be Benefiting From

Explore seven less-known auto insurance discounts that you could be eligible for. Uncovering these can lead to significant savings on your policy

-

Mortgages Oct 14, 2023

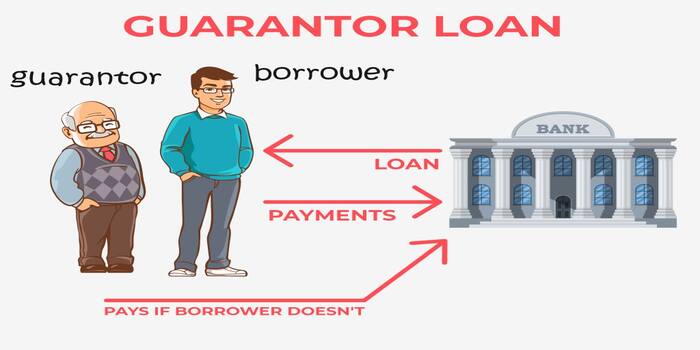

Mortgages Oct 14, 2023A Quick Guide: What Are Guarantor Loans?

The financial phrase "guarantor" refers to an individual who, in the case of a borrower default, will step in to cover the debt. The guarantors' assets secure loans. Sometimes, borrowers would act as their guarantors by putting up collateral against a loan. It's common to practice using the words "guarantor" and "surety" interchangeably.

-

Mortgages Oct 14, 2023

Mortgages Oct 14, 2023Does Inflation Cause a Recession

Are you curious about the relationship between inflation and recession? Dive into this article to understand how they work together and get insights from professional economists.

-

Banking Feb 24, 2024

Banking Feb 24, 2024Tips for Mastering the Customer Service Call

You may expect an automated voice to direct you through the touch-tone menu options most of the time. Your question will most likely fit into one of the subheadings on the menu. One of the first things people look for when using a touchscreen device is their checking or savings account balance